Detector

Underwriting

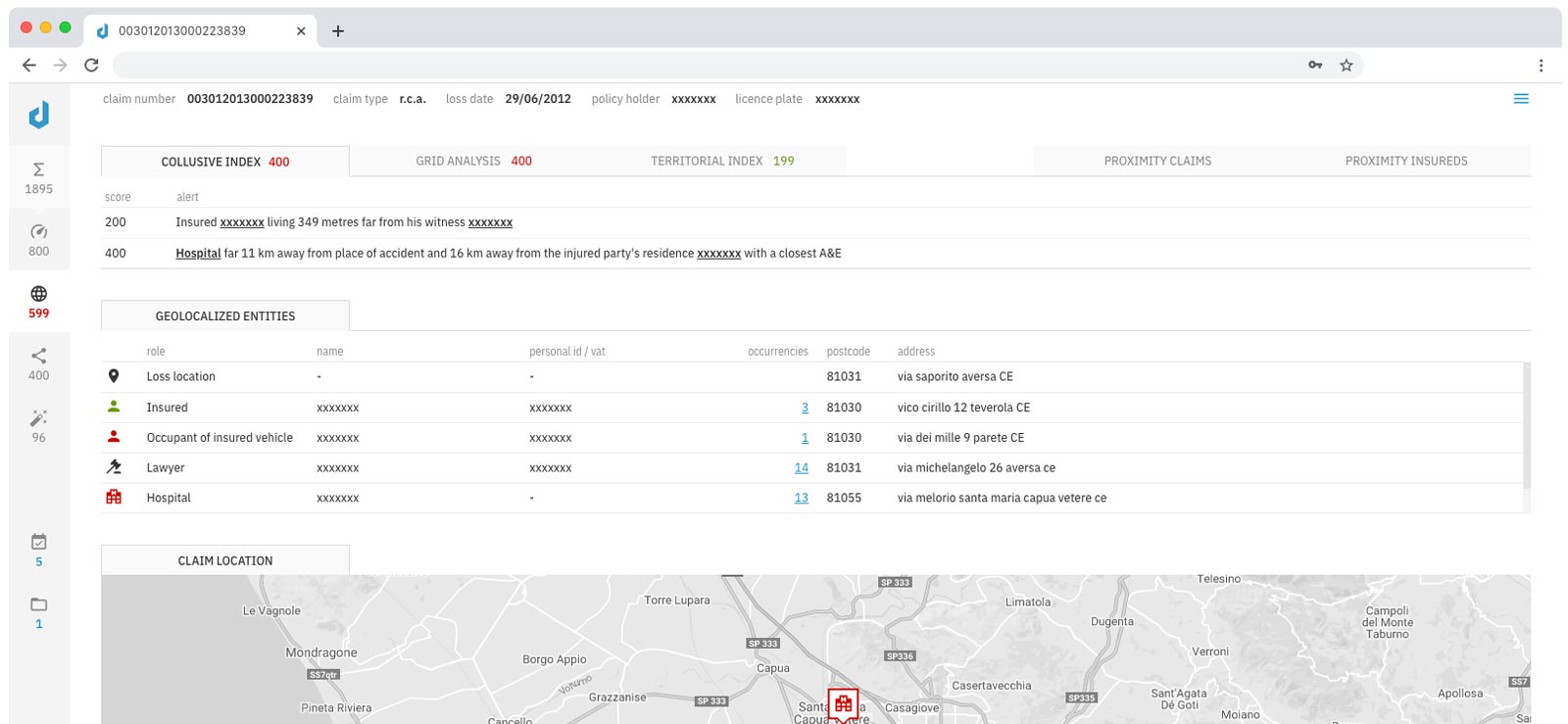

Provides information regarding the level

of risk associated with an insured.

Provides information regarding the level

of risk associated with an insured.

Risk data can be used to safeguard the quality of the insurer’s portfolio, making the underwriting process of a policy less straightforward, for example, by increasing the premium (reducing or cancelling the discount), or when possible, by refusing to issue the contract.

In the case of motor policies, it is important to request additional information from the prospect (e.g. a residence certificate) before finalising the issue process. As with Detector Claims, Detector Underwriting determines the riskiness of a subject through algorithms based on heuristic, geographical and relational criteria.

Detector Underwriting can be easily integrated with the company’s quotation and issuing systems through a simple web interface based on Web Services standards.