Detector overview

Discover how you can boost your ability to detect fraud accurately.

Key figures

Million claims investigated in 2023

General overview

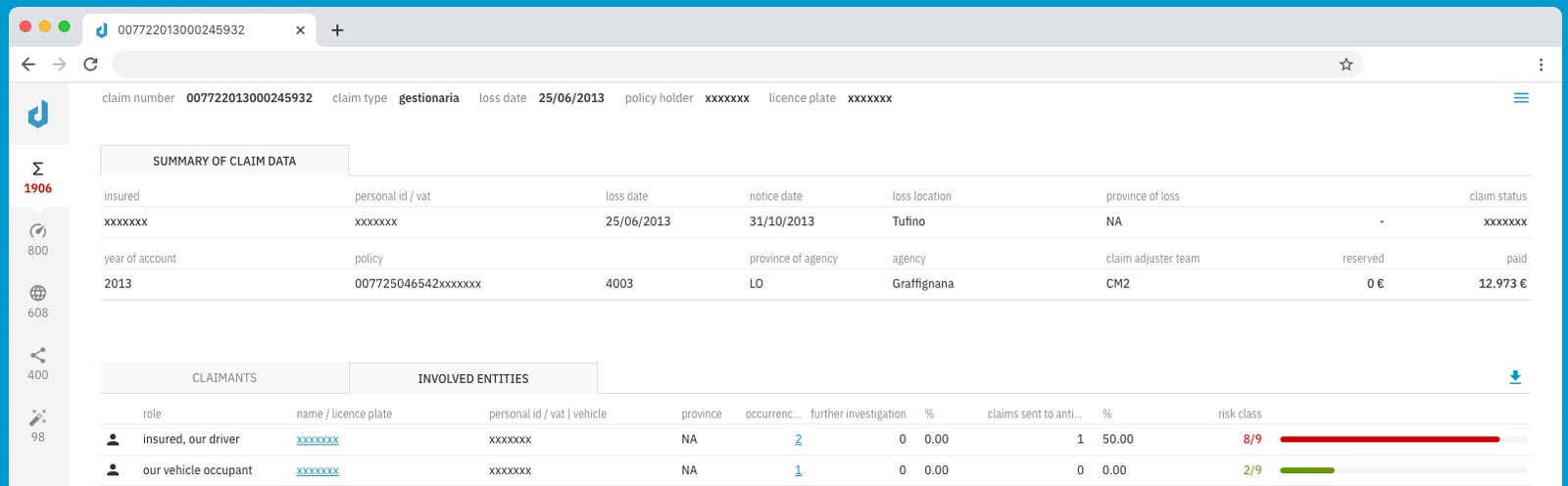

Detector is an innovative software platform for detecting, analysing and managing insurance fraud. Created by claims experts with 35 years of experience, it can be used during both claims settlement and policy underwriting.

The Detector system consists of six independent modules, and insurers can select the modules that best integrate with their systems to strengthen their ability to fight fraud.

The platform evaluates the risk of claims fraud through independent indicators, using a variety of

approaches such as machine learning and geo-localisation, plus relational and socio-economic analysis.

The system is delivered via the Cloud. Easy implementation and rapid integration with in-house insurance systems make for stress-free installation.

Only minimal initial training on Detector is necessary, so your team will be ready to get the most from the platform in next to no time, to make timely and effective decisions.

Benefits

Enhance investigation

Following a scientific approach, Detector singles out risky claims and spots connections that would have passed unnoticed using manual checks.

Easy to Use

Thanks to the ergonomic design of the user interface, all details are easily accessible, and all data can be seen at a glance.

Specialist Excellence

Detector has been designed by business experts and represents a combination of functional experience and innovation, perfected over the past five years.

Better Insight

By shedding light on hidden and recurring relations between the parties involved, Detector provides a deeper understanding of the portfolio.

Reduce loss ratio

The reduction in false positives saves time and resources whilst accelerating payment of legitimate claims. The improvement of investigation efficiency, drives profitability facilitates compliance and helps minimise operational risk.

Continuous improvement

Detector’s cutting-edge predictive engine leverages fraud history and monitors emerging trends to deliver better outcomes.

Benefits

Enhance investigation

Following a scientific approach, Detector singles out risky claims and spots connections that would have passed unnoticed using manual checks.

Easy to Use

Thanks to the ergonomic design of the user interface, all details are easily accessible, and all data can be seen at a glance.

Specialist Excellence

Detector has been designed by business experts and represents a combination of functional experience and innovation, perfected over the past five years.

Better Inside

By shedding light on hidden and recurring relations between the parties involved, Detector provides a deeper understanding of the portfolio.

Reduce loss ratio

The reduction in false positives saves time and resources whilst accelerating payment of legitimate claims. The improvement of investigation efficiency, drives profitability facilitates compliance and helps minimise operational risk.

Continuous improvement

Detector’s cutting-edge predictive engine leverages fraud history and monitors emerging trends to deliver better outcomes.