Know Thy Enemy

Save time, money and effort with Know Thy Enemy.

Key figures

Data points collected in 2023

Key figures

Million claims investigated in 2023

General overview

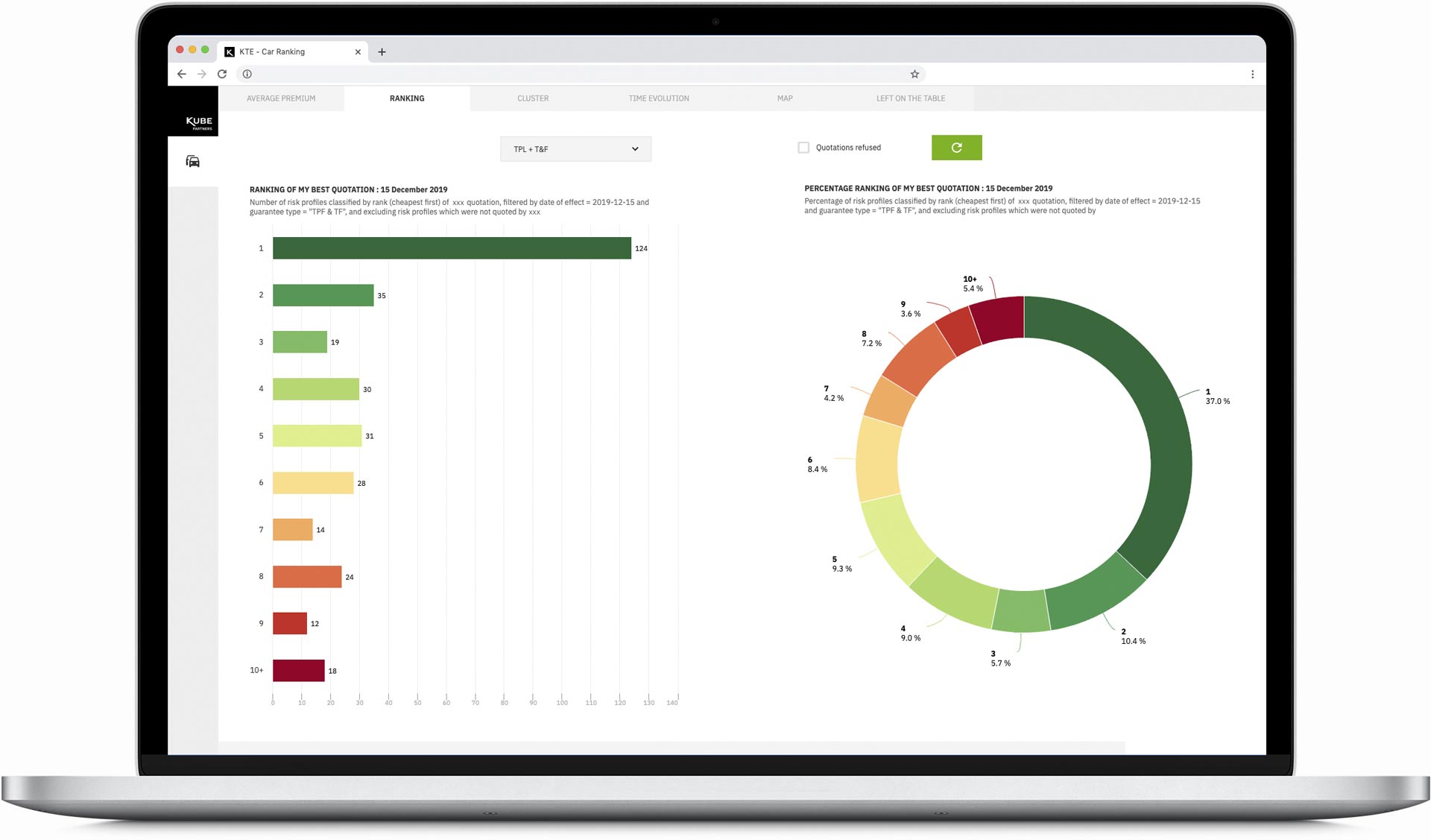

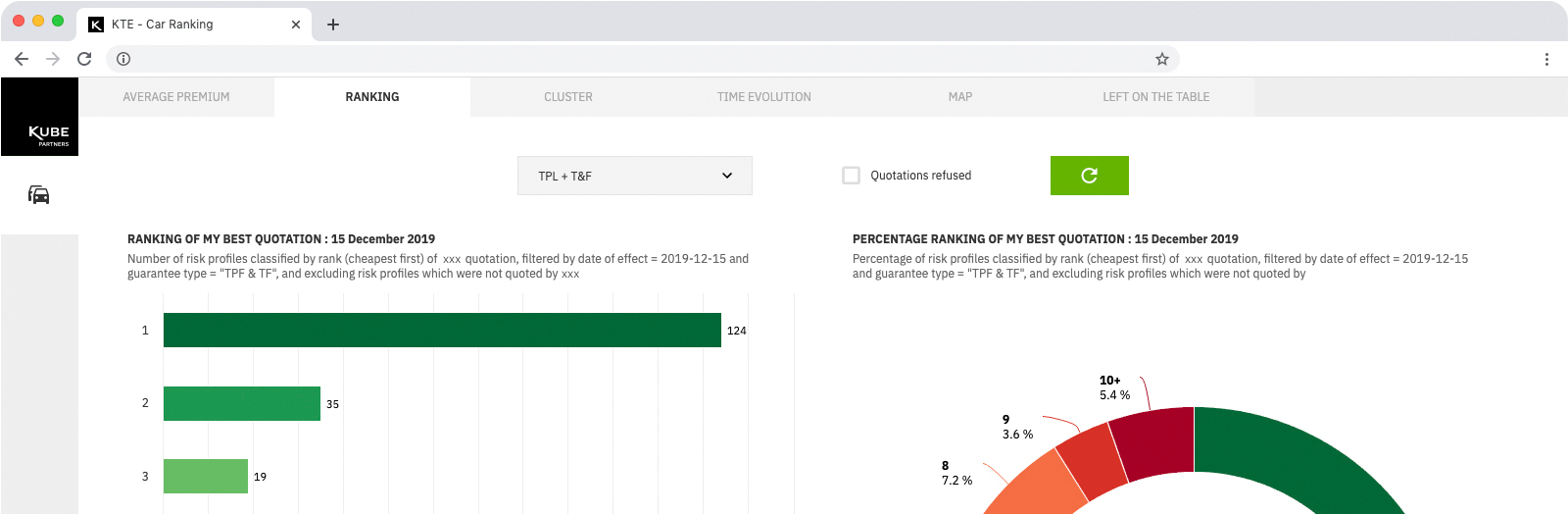

Know Thy Enemy (KTE) is a technological platform for the collection of complex public data over the internet, mostly used to aggregate massive sets of insurance premium quotations for competitive analysis and price optimisation.

It allows companies to see how they perform against their competitors in terms of where they can win or lose. It can be used by a range of people within the

organisation such as underwriters, product managers, marketing teams and, of course, the C-suite.

We have built several ready-to-use business-relevant dashboards adapted for a variety of users, helping major insurance companies, actuarial consultancies and other organisations to gain significant insight and knowledge of their operations.

Benefits

Market view

Enables brands to see how they perform in their chosen market against their key competitors.

Focus on opportunities

Identifies areas where a brand wins and loses against others in the market.

Accessibility

Output accessible to a range of people in the organisation such as pricing teams, marketing and the C-suite.

Competitive advantage

Collects data specific to the organisation and not available to anyone else.

Multipurpose platform

The data can be used to address a range of topics such as developing customer footprints or conducting targeted marketing campaigns.

Understanding customer behavior

Enables a deep understanding of customer preferences and behaviour.

Benefits

Market view

Enables brands to see how they perform in their chosen market against their key competitors.

Focus on opportunities

Identifies areas where a brand wins and loses against others in the market.

Accessibility

Output accessible to a range of people in the organisation such as pricing teams, marketing and the C-suite.

Competitive advantage

Collects data specific to the organisation and not available to anyone else.

Multipurpose platform

The data can be used to address a range of topics such as developing customer footprints or conducting targeted marketing campaigns.

Understanding customer behavior

Enables a deep understanding of customer preferences and behaviour.

KTE Modules

Learn more about the different

modules that make up Know thy Enemy.

Big data

oriented

High volume support for a wide variety of public data. Velocity of collection.

Tailored

risk baskets

Risk baskets that match the needs of the organisation can be created to achieve the most accurate insight applicable to the business.

Role-based

dashboard

Provides relevant information for users in a clean and straightforward way.

No impact

on IT infrastructure

No software installation necessary. We run the entire process and provide access to the data collected via online dashboards, offline reports or machine-to-machine integrations.

Flexible and

agnostic platform

Integrable with arbitrary services and business processes. Embedded QA framework.

Rapid

outcomes

Fully managed projects can deliver data in just a few weeks, depending on complexity.

Some use cases

Client

Direct motor company (France)

REQUIREMENTS

Optimise commercial strategy; monitor and respond quickly to competitor strategies; develop BI dashboard for diverse users; provide a model for on-line discount at underwriting.

OUR SOLUTION

- Analysis and clustering of portfolio and unconverted quotes.

- Construction of a set of representative risk profiles.

- Periodic collection of data to monitor the competitive landscape.

- Machine learning models to optimise the discount for each cluster, based on competitiveness and commercial appetite.

Client

Actuarial solutions provider (Italy, France)

REQUIREMENTS

Obtain accurate data with regular frequency; monitor tariff variations in direct and traditional market; estimate risk factors; spot areas of pricing optimisation.

OUR SOLUTION

- Competitive landscape mapping and selection of companies to monitor.

- Analysis and standardisation of rating factors and their levels for each player.

- Creation of a representative basket of risk profiles.

- Monthly data collection and delivery of analytical reports.

Client

Provider of mobility services and insurance (UK)

REQUIREMENTS

Obtain a deeper knowledge of the customer base to present to main stakeholders; target new potential customers; monitor third-party risk carrier.

OUR SOLUTION

- Agnostic analysis via bias-reducing ML algorithms and synthesis of a few prototype customers for easy-to-understand analysis.

- Analysis of past marketing activity targets and identification of missed opportunities.

- Quarterly data collection on the general market, with specific focus on the organisation’s risk carrier, to monitor products and quotations.

- Delivery of quarterly reports and tailor-made dashboard.